What’s Fueling Ori’s $80M Bet, a Nobel Win, and Nvidia’s Rise?

Discover the secrets behind Ori’s funding talks, AI's Nobel win, and Nvidia’s GPU surge. How these stories are reshaping tech and the global market.

This week, we dive into Ori's AI cloud funding talks, a Nobel Prize for AI pioneers, and major movements in AI infrastructure. Here's your 5-minute breakdown of the top stories shaping the AI landscape.

1. Ori AI Cloud Startup Secures Major Funding Talks

AI cloud startup Ori is in discussions to raise $80 million in fresh funding. The UK-based company, launched in 2019, provides AI infrastructure using Nvidia GPUs like the H100 and A100 for deploying and scaling applications.

Key insights:

Revenue Growth: Ori recorded $42 million in annual recurring revenue as of Q1 2024, projecting to exceed $300 million by Q4.

Strategic Focus: CEO Mahdi Yahya emphasized commitment to the UK’s AI sovereign cloud development, planning to invest nine figures in AI infrastructure over the next two years.

💡 Takeaway: Ori’s growth and funding talks underline the escalating investor interest in AI infrastructure, especially as demand for GPU resources soars.

2. Nobel Prize Awarded to AI Luminaries Hinton and Hopfield

The 2024 Nobel Prize in Physics was awarded to AI pioneers Geoffrey Hinton and John J. Hopfield for their groundbreaking work in machine learning and neural networks.

Key insights:

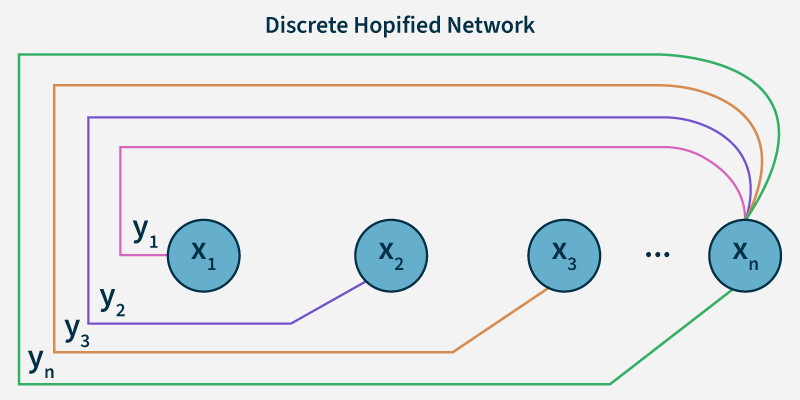

Neural Networks: Hopfield developed the 1982 Hopfield model, crucial for understanding memory and pattern recognition.

Image Recognition: Hinton’s work has revolutionized image recognition capabilities, forming the backbone of modern AI systems.

💡 Takeaway: This recognition reaffirms the importance of foundational AI research, even as the field faces scrutiny over its rapid evolution and risks.

3. Luxury Stocks Dip as Chinese Economic Concerns Impact Wealth

The fortunes of luxury brand moguls like Bernard Arnault of LVMH and François Pinault of Kering declined after China failed to announce expected economic stimulus measures.

Key insights:

Stock Impact: LVMH shares fell by 7%, reducing Arnault’s wealth by $13 billion, while Kering saw an 8% dip.

Global Market Dynamics: The slowdown in Chinese demand continues to affect the global luxury sector, emphasizing its dependency on economic policies in China.

💡 Takeaway: The luxury sector’s volatility highlights the interconnectedness of global markets and the critical influence of economic policies from key regions like China.

Master On-Chain Analysis

Gain deeper insights into blockchain networks with my On-Chain Analysis Course.

What You’ll Learn:

Analyze Bitcoin’s network and spot trends.

Interpret data for market sentiment.

Understand crypto valuations with on-chain metrics.

Clear, actionable modules to help you stay ahead in the crypto space.

4. Dreamwell AI Raises $2.3M in Pre-seed Funding

Dreamwell AI, an influencer marketing startup, raised $2.3 million in a pre-seed round led by Tim Draper. The platform uses AI to automate marketing tasks, including influencer outreach.

Key insights:

Automation Capabilities: Dreamwell’s tools streamline up to 90% of influencer marketing workflows, from prospecting to outreach.

Investor Skepticism: Despite the hype, cofounder Kazzy Khazaal notes that investors are cautious, scrutinizing startups that leverage OpenAI’s technology versus those building proprietary solutions.

💡 Takeaway: The rise of AI in influencer marketing reflects the expanding role of AI in streamlining creative industries, but skepticism remains over genuine innovation versus simple integrations.

5. Nvidia and Super Micro Surge Amid GPU Shipment Growth

Nvidia and Super Micro Computer shares soared following Super Micro’s announcement of shipping over 100,000 GPUs per quarter.

Key insights:

Market Impact: Nvidia’s shares gained 4%, reaching a high not seen since August, while Super Micro’s stock surged by 18%.

Demand Surge: Nvidia’s CEO Jensen Huang highlighted “insane” demand for the next-generation Blackwell GPUs.

💡 Takeaway: The ongoing demand for AI GPUs highlights the growing reliance on powerful AI infrastructure as companies race to scale their AI capabilities.

Final Thoughts

From Ori’s ambitious funding plans to the Nobel recognition of AI trailblazers, the AI industry is buzzing with growth and challenges. As the sector scales, companies must navigate regulatory landscapes and investor expectations to sustain momentum.

Stay informed, stay ahead.

– Shiv Mehta

Disclaimer: The information provided by Insight Labs is for educational purposes only. It is not intended as legal, tax, investment, financial, or any other professional advice.