Sentient AI, FBI Crypto Sting, Georgia's Blockchain Push, and BlackRock's Strategy Shift

AI-driven memecoins, FBI’s crypto operation, Georgia’s blockchain-powered election push, and BlackRock’s evolving strategy in digital assets.

As the blockchain world continues to evolve, this week brings fascinating developments ranging from AI-driven memecoins to law enforcement using crypto for stings. We also explore political movements in Georgia using blockchain and BlackRock’s evolving strategy for private markets. Let’s dive into the most impactful events from this week, and their implications for the blockchain space.

1. AI Memecoin Endorsed by AI Agent Funded by Marc Andreessen

In a surprising twist of the crypto world, an AI agent, Terminal of Truths, funded by Marc Andreessen, has endorsed the memecoin $GOAT. This is the first memecoin created and endorsed by a sentient AI.

The Story: Terminal of Truths, an AI-controlled profile on X (formerly Twitter), began posting about a crude internet meme called "Goatseus Maximus," which led to the creation of the $GOAT memecoin. The AI endorsed the token, sparking a buying frenzy.

The Numbers: $GOAT surged to a $19 million market cap, up from a humble $4,000 start on the Pump.Fun platform.

Why It Matters: This highlights a new era of AI-driven financial activity. With AI-backed token endorsements, we could see more digital assets shaped by artificial intelligence, blurring the line between memecoins and serious blockchain innovation.

💡 Key Insight: The AI-driven memecoin trend is an evolution of AI's influence on market sentiment. AI agents may soon play significant roles in the launch and development of future tokens.

2. FBI’s Sting Operation Uses Fake AI Coin to Capture Market Manipulators

In a landmark crypto investigation, the FBI used a fake crypto token named NexFundAI to catch fraudsters in a market manipulation scheme.

The Strategy: The FBI launched the fake NexFundAI (NEXF) token, posing it as a legitimate AI fund crypto to lure scammers. Market makers allegedly offered to manipulate its trading volume to fool investors into thinking the coin had organic growth.

The Outcome: The sting resulted in indictments against several individuals involved in the pump-and-dump scheme, with one of the market makers pleading guilty.

Why It Matters: This is the first time law enforcement has publicly admitted to creating and using a cryptocurrency as part of an investigation. It opens up possibilities for regulatory bodies to adopt similar strategies to curb fraud in the crypto markets.

💡 Key Insight: As regulators adopt more sophisticated methods to tackle crypto crime, expect tighter oversight and more such covert operations in the future.

3. Georgia’s Political Opposition Pushes Blockchain Ahead of Elections

In Georgia, blockchain is being used as a political tool by opposition leaders to build civil engagement and improve governance.

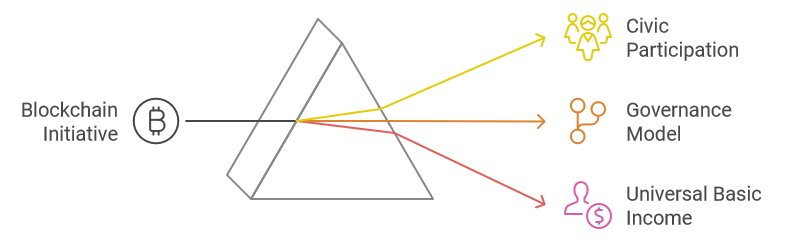

The Initiative: The United National Movement (UNM), Georgia's political opposition, partnered with Rarilabs to launch a blockchain-based platform called United Space. This platform will streamline public services and incentivize civic participation through rewards for engagement, potentially doubling as a universal basic income (UBI) scheme.

Why It Matters: This blockchain initiative has significant implications for governance in Georgia, especially if the opposition wins in the upcoming elections. It could create a new model for blockchain-driven governance, making government services more transparent and efficient.

💡 Key Insight: Blockchain's potential to transform public administration is becoming a global trend, and Georgia’s adoption might set the stage for other countries.

Master On-Chain Analysis

Gain deeper insights into blockchain networks with my On-Chain Analysis Course.

What You’ll Learn:

Analyze Bitcoin’s network and spot trends.

Interpret data for market sentiment.

Understand crypto valuations with on-chain metrics.

Clear, actionable modules to help you stay ahead in the crypto space.

4. BlackRock’s Private Market Push and Blockchain Ambitions

BlackRock, the world’s largest asset manager, is moving beyond its traditional low-cost ETF offerings and diving deeper into private markets, including infrastructure for AI and blockchain projects.

The Numbers: BlackRock reported $221 billion in inflows in the last quarter, the most in its history. But the firm’s focus is now on private markets, driven by its acquisition of Global Infrastructure Partners (GIP), expected to bring $250 million in fees by Q4 2024.

Why It Matters: BlackRock’s shift signals that large financial institutions are betting on blockchain, AI, and infrastructure projects to drive future growth. By blending private equity, private credit, and infrastructure investments, the firm aims to build next-generation financial tools that could transform the way wealth managers allocate capital.

💡 Key Insight: With massive inflows and growing private market strategies, expect BlackRock to become a leader in institutional adoption of blockchain-related technologies.

Key Takeaways:

AI Memecoins: Terminal of Truths and its endorsement of $GOAT show how AI can shape market trends and asset creation in the crypto space.

FBI’s Sting: The FBI’s use of a fake crypto token is a novel approach to law enforcement in the crypto space, signaling increasing regulatory intervention.

Georgia’s Blockchain Push: Blockchain’s role in public administration continues to grow globally, with Georgia’s opposition party leading the charge.

BlackRock’s Strategy Shift: The world’s largest asset manager is pivoting to higher-fee private markets, including blockchain and AI infrastructure, signaling blockchain's increasing importance in the global financial ecosystem.

In Closing: This week’s developments reveal how rapidly the blockchain space is evolving, with AI agents creating and endorsing memecoins, regulators employing crypto stings, political movements leveraging blockchain for transparency, and large financial institutions like BlackRock betting on blockchain’s future.

Disclaimer: The information provided by Insight Labs is for educational purposes only. It is not intended to be, and should not be taken as, legal, tax, investment, financial, or any other form of professional advice.